Household Support Fund

Eligibility Criteria

Those who have a total household income of £31,000 before tax, or, receive at least one Eligible Benefit will be eligible for support under this scheme. Evidence of eligibility will be required.

Eligible Benefits:

a) Armed Forces Independence Payment

b) Attendance Allowance

c) Carer’s Allowance

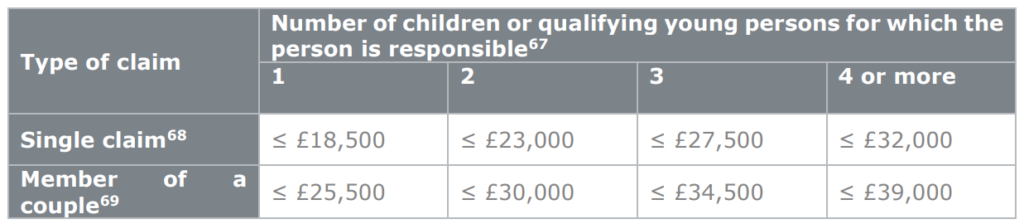

d) Child Benefit (on the condition that the household’s relevant income does not exceed the amount set out below corresponding to the type of claim and the number of qualifying children)

e) Constant Attendance Allowance

f) Disability Living Allowance

g) Pension Guarantee Credit

h) Income-related Employment and Support Allowance (ESA)

i) Income-based Jobseeker’s Allowance (JSA)

j) Income Support

k) Industrial Injuries Disablement Benefit

l) Personal Independence Payment

m) Severe Disablement Allowance

n) Tax Credits (Child Tax Credits and Working Tax Credits)

o) Universal Credit (UC)

p) War Pensions Mobility Supplement

q) Council tax reduction

r) Housing benefit